The Danum Ecosystem Fund invests in shares of publicly listed companies that are developing solutions to the biggest drivers of biodiversity loss and that have the biggest potential to scale.

The Fund does this by identifying innovative business models that hold the promise to halt or even reverse the loss of our planet’s rich biodiversity. The investment team applies a system investing lens to address the root causes of environmental challenges, rather than just the symptoms. The Fund divides the portfolio investments into three categories: fixing and conserving, rearranged value chains and new value chains.

Summary

The Danum Ecosystem Fund focusses on the urgent need for business models to evolve in a manner that either halts or reverses biodiversity loss. Therefore, it aims to select a minimum of 50% of its investments to align with this environmental characteristic. The Fund does not intend to make sustainable investments. The Fund does not select investments based on assurances of their individual impact on biodiversity since such guarantees are challenging to validate. Instead, potential investments should align with one of the following pivotal stages in the journey towards a biodiversity-positive world:

- Fix and conserve: Current system

- Re-arrange: Transitory part of the system

- New Ecosystems: Desired system

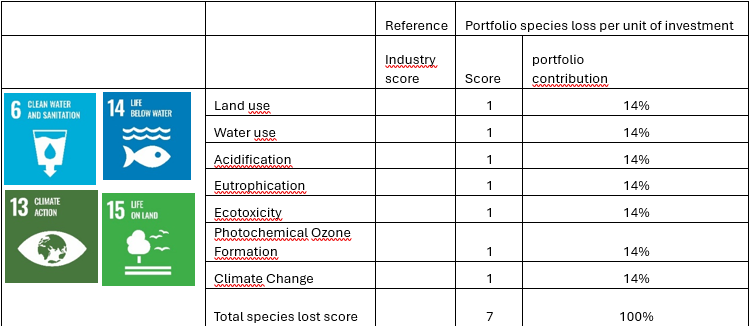

The Fund uses a quantitative score to assess the biodiversity footprint of the portfolio. This score is expressed in species loss per unit of investment and serves as the main indicator to measure the attainment of the biodiversity characteristics of the portfolio.

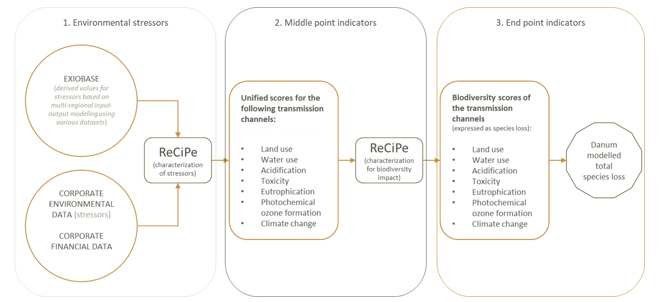

The score is calculated using the Biodiversity Footprint Financial Institutions (BFFI) approach advocated by the Partnership for Biodiversity Accounting Financials (PBAF). The BFFI approach uses the ReCiPe pressure-impact model to quantify the biodiversity impact of corporate environmental pressures in seven categories: land use, water use, terrestrial acidification, eutrophication, ecotoxicity, photochemical ozone formation, and climate change.

It has to be clear that any outcome is a modeled outcome and offers no assurance of the true impact of a company or and industry.

Given the interconnection of ecosystems and the compounded effects of biodiversilty loss, the 7 biodiversity pressure points contribute to at least one but often multiple UN Sustainable Development Goals (SDGs).

The Fund may use derivatives to protect or enhance the financial return profile of cash equity positions, but not the environmental characteristics of the positions.The Fund will not take positions in derivatives that are not linked to a cash equity position. As such, any derivative position that may be taken over time will be directly linked to a position for which the investment process has been completed.

The Fund has adopted an exclusion list of industries, which include Metals & Mining, Basic Chemicals, Automotive production, Semiconductor production and more. The binding elements between all industries on the exclusion list is habitat loss and over-exploitation of species and or natural resources.

Although the Fund uses governance only as a negative screening criterion, governance practices are part of its primary aim to understand the company’s stance and commitments in four critical domains: Biodiversity, Environment, Social, and Governance. These are divided into 21 research-focused questions. The essence of these questions revolves around understanding the company’s strategy and pledges in the aforementioned areas.

On top of this, the Fund developed a quick scan, which allows it to screen for criteria that are deemed important. This scan includes a governance score, which should warn us that a company may have governance issues. If such scores are negative, and further analysis reveal a risk that Fund is not willing to accept, the investment candidate may be removed from the investment universe.

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have as its objective sustainable investment.

Environmental characteristics of the Fund

The Fund focusses on the urgent need for business models to evolve in a manner that either halts or reverses biodiversity loss. Therefore, it aims to select a minimum of 50% of its investments to align with this environmental characteristic. The Fund does not select investments based on assurances of their individual impact on biodiversity since such guarantees are challenging to validate. Instead, potential investments should align with one of the following pivotal stages in the journey towards a biodiversity-positive world:

- Fix and conserve: Current system

- Re-arrange: Transitory part of the system

- New Ecosystems: Desired system

Please find more details in the Pre-Contractual Disclosure Document (Annex II)

- Fix – and conserve: companies that offer remediation services and alike to remove past and current pollution.

- Re-arrange Ecosystems: Business models that allow current corporate ecosystems to make a shift towards partial circularity or offer innovations that provide potential solutions to limit biodiversity loss as a result of traditional business models.

- New Ecosystems: Business models that together drive a systemic transformation towards a biodiversity positive world.

The Fund has instituted investment criteria where merely incremental strategies and enhancements to promote biodiversity are deemed insufficient for inclusion in its investment portfolio. The focus is entirely on the business model of the company and how this eventually may serve biodiversity.

Investment strategy

The Fund adopts a long only strategy and focusses on the urgent need for business models to evolve in a manner that either halts or reverses biodiversity loss. The Fund does not select investments based on assurances of their individual impact on biodiversity since such guarantees are challenging to validate. Instead, potential investments should align with one of the following pivotal stages in the systems transformation towards a biodiversity-positive world:

- Fix and conserve: Current system

- Re-arrange: Transitory part of the system

- New Ecosystems: Desired system

This focus is embedded in the investment process at the very early stage. The investment process (simplified) is structured along three building blocks: Establishing the investment universe; stock selection; portfolio construction. Establising the investment universe embeds our focus on biodiversity using both qualitative as well as quantitative assessments. Once an investment fits the strategy, it enters the more traditional stage of the investment process, which is stock selection and portfolio construction. All three building blocks of the investment process are continuous, meaning companies can be added or withdrawn from the universe or portfolio at any time, depending on developments that may occur. This could include companies changing strategy, changing product profiles, poor execution and more.

Governance

Although the Fund uses governance only as a negative screening criteria, governance practices are part of our primary aim to understand the company’s stance and commitments in four critical domains: Biodiversity, Environment, Social, and Governance. This has been methodically dissected into 21 research-focused queries. The essence of these questions revolves around understanding the company’s strategy and pledges in the aforementioned areas.

On top of this, the Fund developed a quick scan, which allows it to screen for criteria that are deemed important. This scan includes a governance score, which should warn us that a company may have governance issues. If such scores are negative, and further analysis reveal a risk thet Fund is not willing to accept, the investment candidate may be removed from the investment universe.

Proportion of investments

As the Fund’s focus is on the urgent need to halt or reverse biodiversity loss, it aims to select a minimum of 50% of its investments to align with this environmental characteristic. EU taxononomy alignment or sustainable investments are not part of the Fund’s focus so it can be expected that 0% of the Fund’s holdings will be sustainable or EU Taxonomy aligned. The Fund will make direct investments in the equity of companies listed on a public market.

Monitoring of the environmental characteristics

The Fund uses a quantitative score to assess the biodiversity footprint of the portfolio. This score is expressed in species loss per unit of investment and serves as the main indicator to measure the attainment of the biodiversity characteristics of the portfolio.

The Fund also calculates species loss caused by each of the seven corporate environmental pressures. These categorized indicators help to better understand the transmission mechanism of corporate economic activity to biodiversity loss and assists the Fund’s selection of business models that should contribue to fixing and conserving, re-arranging or developing new ecosystems.

It has to be clear that any outcome is a modeled outcome and offers no assurance of the true impact of a company or and industry.

In order to judge if biodiversity outcomes of our investments are aligned with the investment strategy, the Fund will compare the portfolio species loss scores with a modeled score of the reference situation where the corresponding products and services are provided by conventional ecosystems.

To illustrate the attainment of the environmental characteristic, the Fund reports on the total estimated number of species lost per unit of investment figure of the portfolio and on which percentage of its investment portfolio contributes to the 7 biodiversity pressure points.

Given the interconnection of ecosystems and the compounded effects of biodiversilty loss, the 7 biodiversity pressure points contribute to at least one but often multiple UN Sustainable Development Goals (SDGs).

Methodologies

The score is calculated using the Biodiversity Footprint Financial Institutions (BFFI) approach advocated by the Partnership for Biodiversity Accounting Financials (PBAF). The BFFI approach uses the ReCiPe pressure-impact model to quantify the biodiversity impact of corporate environmental pressures in seven categories: land use, water use, terrestrial acidification, eutrophication, ecotoxicity, photochemical ozone formation, and climate change.

Data sources and processing

To assess the environmental characteristics of the company, the Fund uses the following datasources:

- publicly available company reports such as annual reports and sustainability reports

- Exiobase industry data, an opensource database used for life cycle impact analysis

- Data from Bloomberg may be used to supplement the company reports and other publicly available data.

Public company reporting is audited. The Fund monitors the consistency in companies’ reported data and biodiversity plans as a key indicator. A separate sustainability data file per company per year is set up to make inconsistencies easier to spot. Data from Exiobase originates from well-known statistical agencies such as the Central Bureau of Statistics (CBS) in the Netherlands and is used to supplement the Fund’s calculation of biodiversity impacts. Thanks to the combination of multi-year corporate data and the check via Exoiobase, outliers and dubious data are more likely to be spotted and excluded.

The Fund uses programming language Python to process the needed calculations.

All data used comes from external sources and none of the used datapoints are Fund’s estimates. Only third-party data is applied to make calculations regarding the environmental impacts.

Limitations to methodologies and data

With regards to data to calculate the biodiversity profile of a company, there are two limitations of importance: First, data is often incomplete at the company level. Second, any calculation results in a modelled outcome only.

Keeping in mind the potential limitations, the modelled outcomes still allow the Fund to compare companies and sectors. Furthermore, it helps to ask the right questions of the companies and understand the transfer mechanism from corporate action to a potential change in biodiversity resulting from companies’ actions.

Due Diligence

a. Objective Setting:

Stance and Commitments: The primary aim is to understand the company’s stance and commitments in four critical domains: Biodiversity, Environment, Social, and Governance. This has been methodically dissected into 21 research-focused queries. The essence of these questions revolves around understanding the company’s strategy and pledges in the aforementioned areas.

b. Forming an Opinion:

To build a well-informed view, the company’s latest annual sustainability report will be reviewed. Additionally, the transcripts of their last three earnings conference calls will be studied. A quick measure being used is counting keywords to see what issues might be most important for the company. As an example, if ‘water’ appears more than 600 times in the FY22 sustainability report, it indicates water-related issues are significant for the company.

c. Extracting Relevant Data:

Once the documents are reviewed, specific keywords are used to pull out relevant information and quotes. These keywords are closely related to the sustainability topics of interest.

d. Final Assessment:

Combining the findings from reviewing the documents with the information extracted from these documents, a brief assessment is offered. This is presented together with observations and quotes supporting this assessment. Where possible, potential areas for further action are mentioned.

Engagement policies

Engagement on sustainability related issues is not a part of the environmental strategy of the Fund.

Designated reference benchmark

The Fund does not compare its ESG performance to a benchmark or index.

Reporting

Prospectus

- PPM Privium Selection Fund and supplement Danum Ecosystem Fund

- SFDR Pre-contractual disclosure document Danum Ecosystem Fund (version 1.0, June 2024)

Key Information Document

- KID Danum Ecosystem Fund – A Shares (EN)

- KID Danum Ecosystem Fund – A Shares (NL)

- KID Danum Ecosystem Fund – B Shares (EN)

- KID Danum Ecosystem Fund – B Shares (NL)

- KID Danum Ecosystem Fund – C Shares (EN)

- KID Danum Ecosystem Fund – C Shares (NL)

Forms