Aescap Life Sciences aims to gain value by investing in publicly traded shares of biopharmaceutical and life sciences companies and potentially also diagnostics and/or medical device companies. The Fund’s objective is to make an average minimum annual net return (after deduction of costs) of 20%+ over the mid-term (4-5 years). It will typically invest in companies with the potential to (more than) double their share price over a period of maximum 4-5 years. Given the particular innovation power in biotech in Western Europe and North America most investments will be made in these geographical areas. The Fund has a focused portfolio, investing in approximately 20 companies. Within this focus it will ensure that the portfolio is diversified over different diseases, development phases and geographical areas.

Aescap Life Sciences leverages its highly specialized team of analysts and its position as a long-standing and concentrated investor in the biotechnology sector to deeply understand its potential investee companies from both a financial and ESG perspective.

Summary

Aescap Life Sciences (“The Fund”) aims to gain value by investing in publicly traded shares of biopharmaceutical companies and potentially also diagnostics and/or medical device companies. The Fund’s objective is to make an average minimum annual net return (after deduction of costs) of 20%+ over the mid-term. It will typically invest in companies with the potential to (more than) double their share price over a period of maximum 4-5 years.

Next to the goal of creating a financial return for investors, the Fund also promotes a social characteristic. The main focus of the Fund’s investments is in researching, developing, or producing treatment/solutions for diseases with a high unmet medical need. A high unmet medical need has been defined as diseases that are characterized by an (inadequacy of) available treatments, which severely impact the patient and the healthcare system, prevalent in the geographies the company currently markets or plans to market or distribute its current or future product(s).

The Fund aims to construct a portfolio of approximately 20 investee companies that contribute to the social characteristic, and of which a minimum proportion of 30% (of the invested capital of the Fund) are considered sustainable investment. Invested capital is the Fund Assets, excluding cash.

Next to establishing which sustainability risks are considered material for each investee company based on the Sustainability Accounting Standards Board (“SASB”), the Fund also analyses the investee companies’ preparedness to these sustainability risks as part of the due diligence process. The Fund takes the Principe Adverse Impact (“PAI”) indicators into account to determine if an investment can be considered sustainable. It investigates the processes and policies of any potential investment on environmental and social risks in the biotechnology sector as defined by the SASB and by the PAI indicators.

Monitoring of investee companies regarding their Environmental, Social and Governance (“ESG”) performance happens monthly based on sustainability risks, investment allocation towards to the social characteristic and the proportion of the investments determined as sustainable.

The Fund engages with investee companies to improve their ESG performance through engagement. Engagement can consist of meetings with management, data requests to investor relations to improve the policies and practices or formal voting of the investee companies when considered necessary.

Reporting happens on a monthly and quarterly occasion with updates on the financial returns. The Fund publishes an annual principal adverse impact report highlighting the engagement activities of the Portfolio Manager as well as any changes in policies and practices of the investee companies.

No sustainable investment objective

The Fund promotes a social characteristic but does not have as its objective sustainable investment. The Fund aims to have a minimum proportion of 30% of sustainable investments that contribute to the social characteristic.

- The Fund will, in determining the 30% proportion of sustainable investments, take the PAI indicators into account. It investigates the processes and policies of any potential investment on environmental and social issues in the biotechnology sector as defined by the SASB and by the PAI indicators.

Which risks are material to the Fund and its investments is outlined in detail on the Fund’s website. In addition, the Fund excludes potential investments with a history of poor performance on sector best practice that have insufficient policies or that have insufficient plans to improve in their social and environmental impact.

The fund has prioritized he PAI indicators into “very important” and “important”, respectively based on their relevancy to the biotechnology sector and the specific areas where a company is most likely to do significant harm. Two of the mandatory PAI indicators are not deemed relevant for the companies within the scope of investment of the fund. The Fund’s PAI statement, available on its website, contains a detailed explanation of the PAIs considered. If the fund deems an investment is at risk of having a negative impact/doing significant harm on more than 1 of the very important indicators or on 5 or more of the important indicators, then the investment cannot be classified as sustainable. It may still contribute to the fund’s social characteristic, however. - Each analysis includes a scan for violations of the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights for processes and compliance mechanisms that each investment needs to have.

Please find more details in the Pre-Contractual Disclosure Document (Annex II)

Social characteristics of the financial product

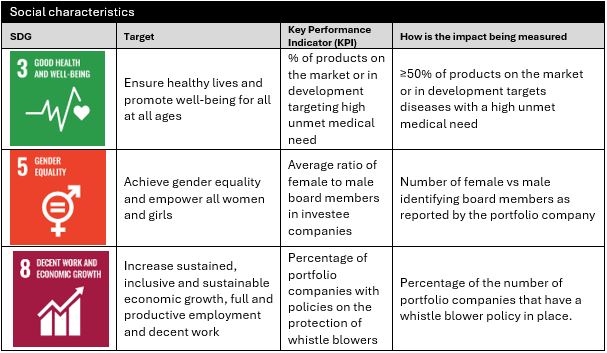

In addition to the Fund’s financial aim to gain value by investing in publicly traded shares of biopharmaceutical, diagnostics and/or medical device companies, it also promotes a social characteristic. The focus of the Fund’s investments is on researching, developing, and/or producing treatment/solutions for diseases with a high unmet medical need.

The Fund considered the heterogeneity behind this notion and defined that these types of diseases (for example Alzheimer’s Disease, Arthrosis, Diabetes, Multiple Sclerosis, Cancer, Parkinson’s Disease) are characterized by:

- the inadequacy of available treatments

- severity of impact on the patient

- and on the healthcare system in the geographies the company currently markets or plans to market or distribute its current or future product(s).

The Fund believes the inadequacy in these three items encompasses what an unmet medical need is in healthcare and biotechnology.

The Fund acknowledges the importance of a diverse mix of employees as well as strong corporate controls to develop treatments that work for all patients while maintaining the best working conditions and the highest quality levels in their processes. Therefore, the Fund considers and reports on the gender equality in investee companies’ boards as well as their internal whistle blower policies.

By reporting on the number of female-identifying board members and engaging with portfolio companies to collect this information alongside other employee engagement and diversity information, the sector is encouraged to improve its hiring practices and ultimately benefit from having diverse teams.

By reporting on the level of whistle blower policies and engaging with portfolio companies to collect this information, the sector is encouraged to foster the best working conditions and the highest quality levels in their medical treatment development processes.

Please find more details in the Pre-Contractual Disclosure Document (Annex II)

Investment strategy

The Fund aims to gain value by investing in publicly traded shares of biopharmaceutical and life sciences companies and potentially also diagnostics and/or medical device companies. The Fund has a focussed portfolio, investing in approximately 20 companies with the potential to (more than) double their share price over a period of 4-5 years. It aims to make investments in companies globally, but most investments are likely to be made in companies located in Europe and Northern America given the innovation power in biotech in these markets.

The Fund’s investment team has a deep knowledge of the biotechnology sector and the ability to understand investee companies from both a financial and ESG perspective.

The ESG evaluation includes a good governance analysis, determining the intended investment’s preparedness to deal with material governance risks identified by SASB. If an intended investment is found to have a low average preparedness on any of the material governance risks investigated, the Fund may include the investment in its portfolio and start an engagement project to improve its preparedness.

More details can be found in the Prospectus

Proportion of investments

The Fund aims to select as much of its portfolio as possible to be aligned with its social characteristic and targets a minimum of 30% of the Fund’s invested capital. This consists of:

- listed shares of biopharmaceutical companies and potentially also diagnostics and/or medical device companies.

- warrants of such companies. Often these warrants are received as part of an equity issue by a company.

Other fund holdings may be:

- Cash: the Fund may hold cash freely available for investment or cash for portfolio management purposes.

- Borrowings: the Fund may temporarily borrow (no longer than one month) up to 10% of its NAV for portfolio management purposes or to benefit from an investment opportunity.

- Non-aligned assets: holdings whose activities do not contribute to the social characteristic of the fund. For non-aligned assets, at minimum a material ESG risk analysis based on the standards of the SASB is performed.

More details can be found in the Prospectus

Monitoring of environmental or social characteristics

The Fund has determined that an investment that contributes to the Fund’s promotion of social characteristic needs to be an investment that is researching, developing, or producing treatment for diseases with a high unmet medical need. The Fund will analyse per investee company what percentage of their activities is related to developing drugs for diseases with high unmet medical need.

The Fund monitors the attainment of the social characteristic:

- Monthly monitoring of investment allocation towards the Fund’s social characteristic with the percentage of investee companies researching, developing or producing treatment for diseases with a high unmet medical need

- Monthly overview of the Fund’s exposure to sustainability risks are reviewed and discussed in the monthly meetings.

- Progress on ESG best-practice engagement

The Fund reports the attainment of the social characteristic it promotes:

- annually on the percentage of investee companies researching, developing, or producing treatment for diseases with a high unmet medical need

- annually on the engagement priorities with investee companies using the findings from the ESG material risk analysis and Do No Significant Harm analysis.

The companies the Fund invests in should not only have strong financials, good management and comply with the regulations, but they should also continue to improve their ESG performance wherever possible. The Portfolio Manager has a long history of investing in- and engaging with biotech companies. Engagement with small-cap companies can be very effective and can have a concrete and direct impact on their policies and practices.

Please find more details in the Pre-Contractual Disclosure Document (Annex II)

Methodologies for environmental or social characteristics

The Fund uses the following methodologies to measure how investments contribute to the social characteristic of the fund:

- The Fund applies the Materiality Map of the SASB to determine which sustainability risks are material to consider in the investment decision-making process. SASB has identified more than 25 sustainability risks divided across the E, S, and G topics. Dependent on the economic sector the investment is active in, these risks are marked either: 1) not material, 2) not likely material, 3) likely material. For a risk to be classified as likely material, SASB has found that for over 50% of the companies active in that sector, the risk has a significant impact on the financial position or operational activities. The Fund performs an analysis based on policies, practices, and incidents to determine if the investee company has a low, average or high estimated sensitivity of the value of the investment to material sustainability risks.

- The Fund determines if a company qualifies to contribute to the attainment of the Fund’s social characteristic if:

- For a company with product(s) on the market that has been profitable in the past 3 years:

≥ 50% of the products it markets are aimed at treating diseases with a high unmet medical need - For an unprofitable company with product(s) on the market or for a company without product(s) on the market:

≥ 50% of its pipeline programs and products on the market are aimed at treating diseases with a high unmet medical need

- For a company with product(s) on the market that has been profitable in the past 3 years:

If a company qualifies, then the actual percentage of pipeline programs and/or products on the market addressing a high unmet medical need will be used in the calculation of how much of fund’s assets under management (“AUM”) is contributing to this characteristic, proportionate to that company’s weight in the portfolio. If a company does not qualify, then it counts for 0% to the fund’s calculation of AUM contribution to the high unmet need goal.

Please find more details in the Pre-Contractual Disclosure Document (Annex II)

Data sources and processing

The Fund uses data for the following purposes:

- Sourcing of the investee companies

- Monitoring the sustainability risks

- Reporting on PAI indicators and engagement activities

Data used and processed by the Fund to attain the social characteristic and report on PAI indicators are as follows:

- Sources: Publicly available investee company data financials, company policies, annual reports and ESG ratings from external entities. PAI indicators data requested by the Fund to the investee company

- Data quality:

An investment candidate needs to be willing to communicate and/or share information regarding the relevant topics and risk factors for the fund ESG policy (e.g. SASB, PAI). - Data processing: the Fund processes data from investee companies via a software provider, checks the received data and does not process data beyond preparing investor communications with data received.

Limitations to methodologies and data

The Fund expects limitations to occur with the current methodologies and data collection as investee companies may be subject to differing legislation and regulatory requirements. As reporting on sustainability issues matures, the availability of data related to sustainability, the Fund’s methodology and data sources is expected to evolve

Due diligence

The Fund follows the below investment processes, including due diligence:

- Sector coverage: all securities in the biotechnology sector reviewed annually with research, screening, data analysis, information gathered in the field.

- Identification of Edge vs market: Using proprietary financial models as the basis of the Fund’s expectation for a company the teams review potential new investments quarterly against market expectation.

- Investment thesis construction: Securities reviewed monthly to map to which extent they fit into the Fund’s portfolio. A review regarding the contribution to the Fund’s social characteristic is part of this analysis.

- Constant monitoring: after the team has reached their conviction regarding a security an investment decision is made by the Portfolio Manager. Findings from the ESG material risk analysis and Do No Significant Harm analysis are combined to inform the engagement priorities for a portfolio company.

- All investments and their contribution to the Fund’s social characteristic are audited annually by an external third party.

Please read more details in the Prospectus

Engagement policies

The Fund upholds the following approaches with regards to engagement with its investee companies:

- Indicator to monitor if an investee company contributes to the social characteristic: the investee company the Fund invests in should not only have strong financials, good management but they should also continue to improve their ESG performance wherever possible. On an ongoing basis, the sustainability risk analyses for the investments of the Fund are reviewed and updated when applicable. Material changes to the individual sustainability risks of an investment are not expected to occur often. In addition, the Fund excludes potential investments with a history of poor performance on sector best practice that have insufficient policies or that has insufficient plans to improve in their social and environmental impact.

- Voting: As an active investor, the Fund regularly engages with companies on a wide range of topics, including ESG and other factors related to investment fundamentals. Through its regular monitoring and screening activities engagement is initiated when the Fund identifies a concern. The Fund engages with an investee company through meetings/calls with the company’s management or Chairperson, email communications with investor relations or company representatives on specific matters, company site visits, interactions with external industry experts or other industry participants and action through formal voting.

Progress on the portfolio’s ESG performance and the Fund’s engagement activities is reported on in the Fund’s Principal Adverse Impact report.

Please read more details in the PAI report

Designated reference benchmark

The Fund does not compare its ESG performance to a benchmark or index.

Reporting

- Annual Report 2023 Aescap Life Sciences

- Annual Report 2022 Aescap Life Sciences

- Annual Report 2021 Aescap Life Sciences

- Interim Financial Statements 2024 Aescap Life Sciences

- Interim Financial Statements 2023 Aescap Life Sciences

- Interim Financial Statements 2022 Aescap Life Sciences

- Monthly Statement Article 50 Bgfo Aescap Life Sciences

Prospectus

- Prospectus Aescap Life Sciences

- Supplement to Prospectus Aescap Life Sciences

- Explanation regarding Supplement to Prospectus Aescap Life Sciences

- SFDR Pre-contractual disclosure document Aescap Life Sciences (version 2.3, August 2024)

- PAI Report 2023 Aescap Life Sciences

Key Information Document

- KID Unit Class Aescap Life Sciences – Manager (EN)

- KID Unit Class Aescap Life Sciences – Manager (NL)

- KID Unit Class Aescap Life Sciences – Investors (EN)

- KID Unit Class Aescap Life Sciences – Investors (NL)

- KID Unit Class Aescap Life Sciences – Investors Allfunds (EN)

- KID Unit Class Aescap Life Sciences – Investors Allfunds (NL)

- KID Unit Class Aescap Life Sciences – Investors < 500k (EN)

- KID Unit Class Aescap Life Sciences – Investors < 500k (NL)

- KID Unit Class Aescap Life Sciences – Investors N (EN)

- KID Unit Class Aescap Life Sciences – Investors 10M+ (EN)

- KID Unit Class Aescap Life Sciences – Investors 10M+ (NL)

- KID Unit Class Aescap Life Sciences – Investors 20M+ (EN)

- KID Unit Class Aescap Life Sciences – Investors 20M+ (NL)

- KID Unit Class Aescap Life Sciences – Investors 30M+ (EN)

- KID Unit Class Aescap Life Sciences – Investors 30M+ (NL)

Forms