News archive

Privium Fund Management appointed as Fund manager of the TPM Privium Private Equity program

As of February 12th, Privium’s Amsterdam office has been appointed as fund manager of the TPM Privium Private Equity Program 2024. The fund invests into

Emerging Manager Survey 2024

The Alternative Investment Management Association (AIMA) and Marex have published the Emerging Manager Survey 2024, which reports on hedge fund managers running up to $500

TPM Privium Private Debt Portfolio launched

The TPM PPDP solution is designed to provide European private wealth investors with diversified exposure to private debt with appropriate liquidity. This week Truffle Private Markets Group,

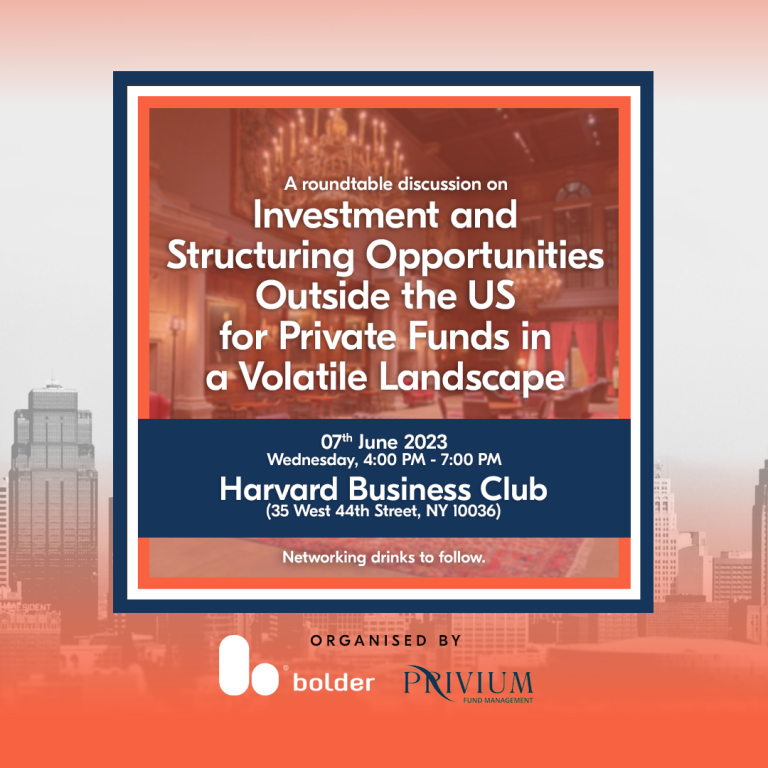

Investment and structuring opportunities for private funds outside of the United States.

Privium New York and Bolder Group will host an exclusive roundtable discussion on Wednesday 7th June 2023 at the Harvard Club in New York. In

Launching Privium in the US: Miami, New York meetings and more

Over the last two weeks Clayton Heijman and Vanessa Hemavathi took the opportunity to kickstart Privium’s activities in the US with a visit to iConnections

Season’s Greetings from all of us to you

With this calendar year having flown by, where we can look back at several new initiatives and experiences, we hope this message finds you in

Privium Fund Management accelerates global growth into the US with opening of New York office

Privium Fund Management (hereafter ‘Privium´) is proud to announce the opening of its first US office in January 2023, which will be located in 45

Alternatives in the Asian Century: How do they offer an entry point into the Asian growth story?

Panel discussion and networking drinks on Thursday 20th October in Singapore Please join us on Thursday 20th of October 2022 for an interactive evening

Expediting access to Asia: How global investment managers are leveraging outsourced solutions

AIMA webinar in partnership with Privium Fund Management The alternative investment industry is expected to grow globally in the next few years, with the Asia

Setting up a Singapore Domiciled Fund (VCC) – Why & How?

Please join us on 2nd September at 3 p.m. HK / SG time where our colleague Filippo Shen will participate in a webinar about “Setting up

Alert! Privium Fund Management has no connections with PriviumEX, Privium Exchange, Privium Impact etc.

ALERT: Privium Fund Management wants to notify that it has no connections, dealings or other links with firms working under the name of PriviumEx, Privium

Privium Fund Management sees AuM cross the USD 4 billion mark, despite market turbulence

The investment management solutions company, Privium Fund Management, has achieved another key milestone, growing Assets under Management (AuM) to over USD 4 billion in the

Runnin’ on plenty; the shareholder 5K on Sunday

After a terrific dinner organised by Mayar Capital it was again an early start…this time to sing the US national anthem and run 5k with

A photo impression of BRK 2022

After putting it on hold for two years the annual meeting of Berkshire Hathaway was held in Omaha Nebraska. The town that brought us Gerald

Our CEO will be sharing his experiences from Berkshire Hathaway Annual Meeting 2022

We are excited that our CEO Clayton Heijman will share his behind the scenes images and mostly insights from the first in-person Berkshire Hathaway annual

Treety and Privium announce partnership to create SFDR and positive impact reporting

We are proud and excited to announce the strategic partnership between Treety B.V. and Privium Fund Management B.V.. Our companies plan to lead the way

How can the Hong Kong LPF benefit managers in the region?

Please join us on 14th January at 2 p.m. HK time where our colleague Filippo Shen will participate in a webinar about Limited Partnership Fund

Webinar China commodity outlook 2022

Please join us on 12/6 for a Live Webinar jointly organized by Horizon Insights, Minmetals Futures Co., Ltd. and Privium Fund Management. We will